Expanded Accounting Equation Examples Concept Explanation

Accounts shows all the changes made to assets, liabilities, and equity—the three main categories in the accounting equation. Each of these categories, in turn, includes many individual accounts, all of which a company maintains in its general ledger. Net income reported on the income statement flows into the statement of retained earnings. If a business has net income (earnings) for the period, then this will increase its retained earnings for the period. This means that revenues exceeded expenses for the period, thus increasing retained earnings. If a business has net loss for the period, this decreases retained earnings for the period.

Passive Income Hacks to Cover Tuition Expenses While Studying

The Financial Accounting Standards Board had a policy that allowed companies to reduce their tax liability from share-based compensation deductions. This led companies to create what some call the “contentious debit,” to defer tax liability and increase tax expense in a current period. See the article “The contentious debit—seriously” on continuous debt for further discussion of this practice. The Financial Accounting Standards Board had a policy thatallowed companies to reduce their tax liability from share-basedcompensation deductions.

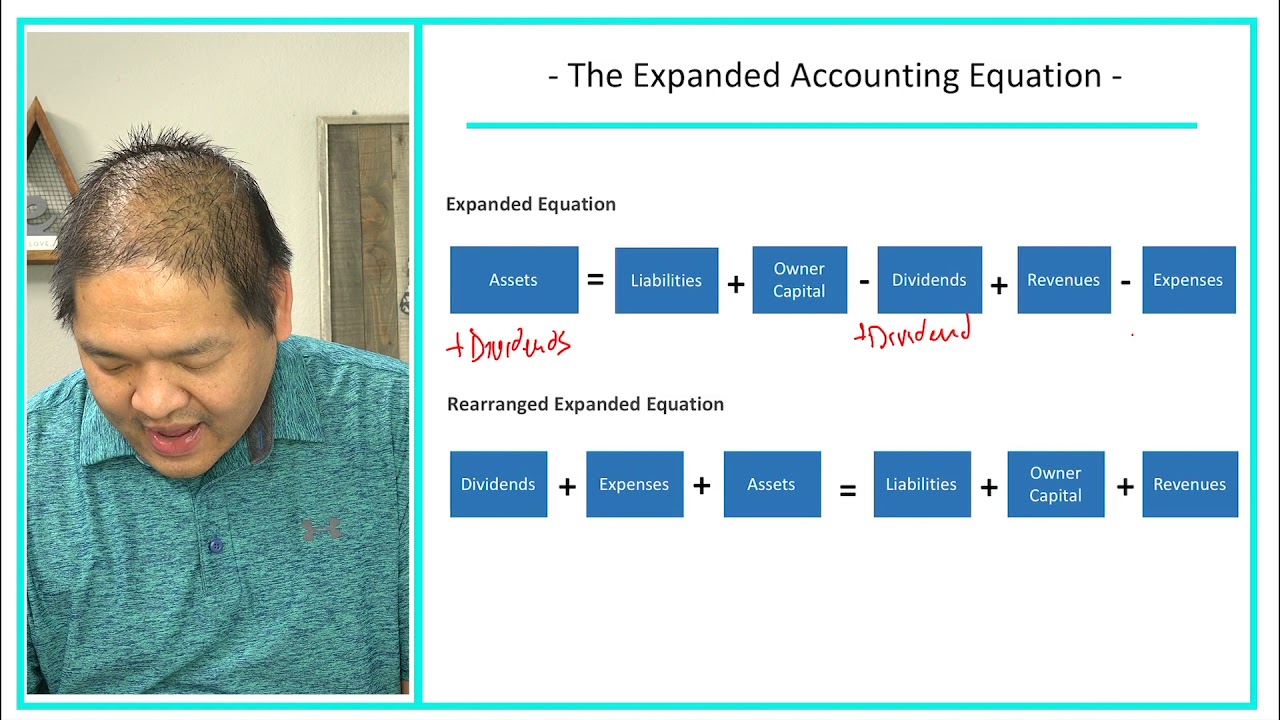

29: Expanded Accounting Equation

The expanded accounting equation breaks down the equity portion of the accounting equation into more detail. This expansion of the equity section allows a company to see the impact to equity from changes to revenues and expenses, and to owner investments and payouts. It is important to have more detail in this equity category to understand the effect on financial statements from period to period.

- Even though the business does not have to pay the bill until June, the business owed money for the usage that occurred in May.

- You will notice that stockholder’s equity increases with commonstock issuance and revenues, and decreases from dividend payoutsand expenses.

- Liabilities are obligations to pay an amount owed to a lender (creditor) based on a past transaction.

- This is useful for outside analysts, who base their stock recommendations on detailed analyses of this type.

- Notice that all of the equations’ assets and liabilities remain the same—only the ownership accounts are changed.

Stockholder’s Equity

Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Our mission is to improve educational access and learning for everyone.

This means that the expenses exceeded the revenues for the period, thus decreasing retained earnings. Eventually that debt must be repaid by performing the service, fulfilling the subscription, or providing an asset such as merchandise or cash. Some common examples of liabilities include accounts payable, notes payable, and unearned revenue. The increases (credits) to common stock and revenues increase equity; whereas the increases (debits) to dividends and expenses decrease equity.

Accounting and Accountability

Some common examples of liabilities includeaccounts payable, notes payable, and unearned revenue. The basic accounting equation is used to provide a simple calculation of a company’s value, based on a comparison of equity and liabilities. For a more specific breakdown of the components of equity, use the expanded equation instead. The beginning retained earnings is a measure of the stockholders’ equity at the beginning of the calculation period so the impact of contributed capital, dividends, revenue, and expenses can be measured.

Liabilities are obligations to pay an amount owed to a lender(creditor) based on a past transaction. It is important to understand that when we talkabout liabilities, we are not just talking about loans. Moneycollected for gift cards, subscriptions, or as advance depositsfrom customers could also be liabilities. Essentially, anything acompany owes and has yet to pay within a period is considered aliability, such as salaries, utilities, and taxes.

Examples of supplies (office supplies) include pens, paper, and pencils. At the point they are used, they no longer have an economic value to the organization, and their cost is now an expense to the business. The first step to do so is to learn how to identify and analyse tax relief for taxpayers affected by oregon wildfires business events or transactions. Then it will be a matter of identifying the accounting components and recording the transaction. At the point they are used, they no longer have an economic value to the business, and their cost is now an expense to the business.